Extract European Grocery Product Data from HEMA and Woolworths

Introduction

The European grocery retail market has experienced rapid transformation between 2020 and 2025, driven by shifting consumer preferences, rising e-commerce penetration, and dynamic pricing strategies. To stay competitive, grocery brands and retailers need actionable insights into pricing, product availability, and consumer behavior. By leveraging AI-powered scraping solutions to Extract European Grocery Product Data from HEMA And Woolworths, businesses can track market trends, SKU-level performance, and promotions across Europe in real-time.

For instance, HEMA and Woolworths have continuously adjusted their grocery assortments and promotional campaigns, making manual tracking inefficient and error-prone. Through HEMA and Woolworths Product Data Extraction API, companies can automate data collection, ensuring timely updates on price changes, product launches, and discount offers. By integrating these insights into dashboards, retailers gain a comprehensive view of the market landscape, enabling smarter decisions for category management, competitive pricing, and consumer targeting.

With Extract European Grocery Product Data from HEMA And Woolworths, businesses can also benchmark SKU performance across regions, monitor seasonal trends, and understand consumer demand patterns. This blog explores how Product Data Scrape empowers organizations to leverage HEMA and Woolworths data for optimized grocery strategies and superior market intelligence.

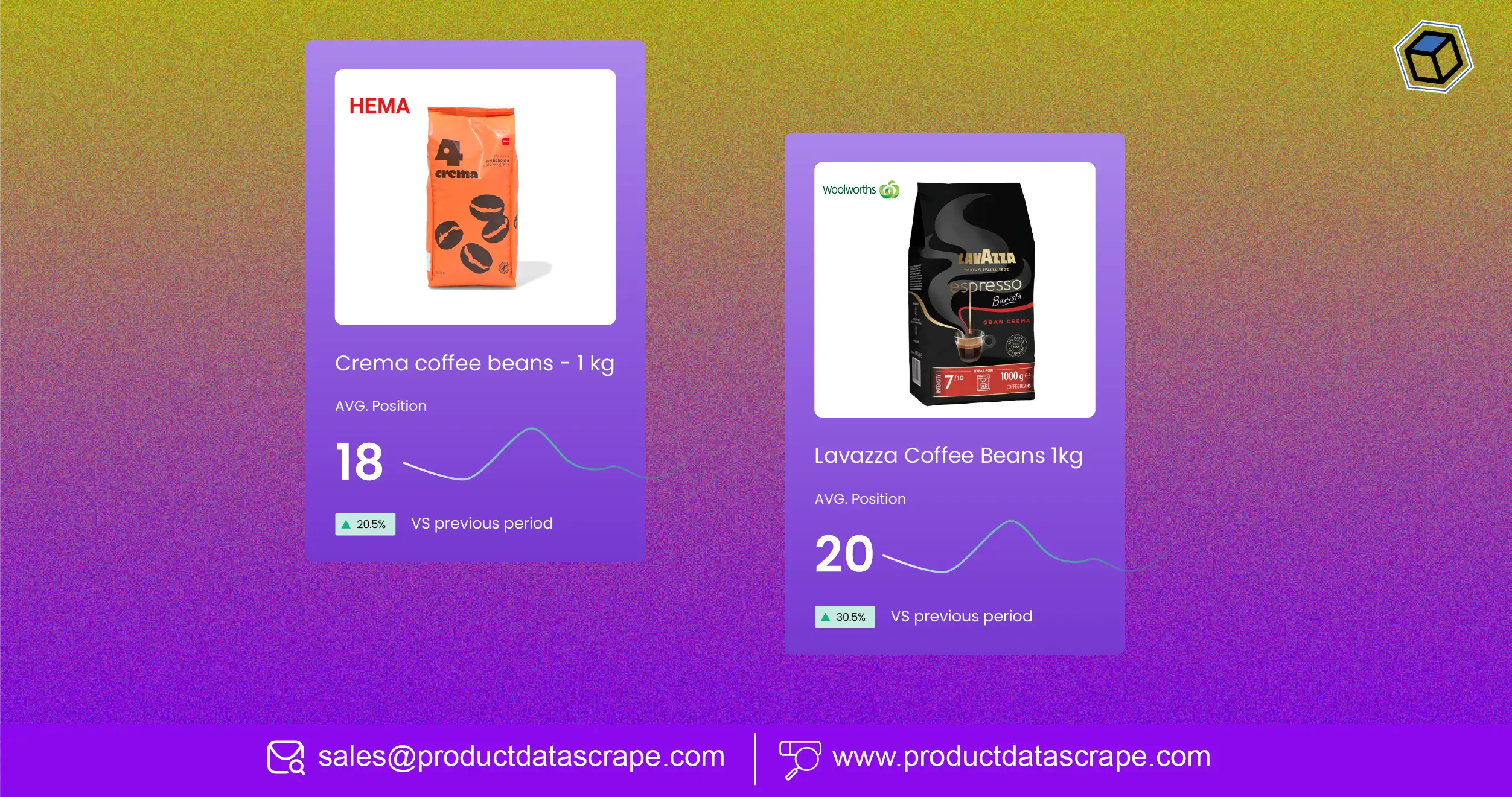

HEMA & Woolworths Product Insights (2020–2025)

Tracking grocery SKU trends in Europe requires accurate, frequent data collection. By using Scrape Woolworths Grocery Listings for Europe and Scrape HEMA Grocery Listings for Europe, retailers can monitor product availability, pricing patterns, and category-level performance. Between 2020 and 2025, HEMA expanded its grocery offerings from 1,200 to 1,800 SKUs, while Woolworths added over 2,500 new products across beverages, snacks, and pantry essentials.

| Year | HEMA SKU Count | Woolworths SKU Count |

|---|---|---|

| 2020 | 1,200 | 2,300 |

| 2022 | 1,500 | 2,450 |

| 2025 | 1,800 | 2,500 |

By leveraging Scraping European Supermarket Prices & Promotions, retailers can detect price fluctuations, promotional patterns, and discount strategies. For example, Woolworths frequently adjusted beverage pricing by up to 12% seasonally, while HEMA introduced bundle offers on snacks to boost sales.

Extract European Grocery Discounts Data provides insights into how discounts influence consumer behavior. Across 2020–2025, promotional campaigns contributed to a 15% increase in repeat purchases for HEMA and a 20% increase for Woolworths.

Using European Grocery SKU Tracking via Web Scraping, retailers can identify high-demand SKUs, anticipate inventory needs, and optimize assortments. This data is essential for category managers and pricing analysts aiming to maximize sales and improve consumer satisfaction.

Pricing Trends & Market Dynamics

Dynamic pricing is a core driver of European grocery retail growth. Between 2020 and 2025, HEMA and Woolworths implemented automated pricing strategies to remain competitive, requiring constant monitoring. European Grocery Market Intelligence tools allow retailers to observe pricing changes by category, region, and SKU, enabling data-driven decision-making.

For example, Woolworths beverage pricing varied by up to 10% between urban and suburban stores, while HEMA adjusted snack pricing by up to 8% during holiday periods. Using Track Grocery SKU Trends in Europe via Scraping, businesses can detect such micro-market variations and respond quickly.

| Year | Average Price Change HEMA | Average Price Change Woolworths |

|---|---|---|

| 2020 | 5% | 4% |

| 2022 | 6% | 5% |

| 2025 | 8% | 7% |

By Extract Grocery & Gourmet Food Data , retailers gain a unified view of grocery trends, enabling effective pricing optimization, inventory management, and promotion planning. AI-driven scrapers also reduce manual errors, improve accuracy, and provide real-time insights that enhance competitiveness in a crowded European market.

Track pricing trends and market dynamics in real-time—leverage AI to monitor HEMA & Woolworths grocery prices across Europe!

Product Availability & Inventory Monitoring

Maintaining consistent stock across stores is critical for customer satisfaction. Using Web Scraping Woolworths Data and Extract Hema Grocery & Gourmet Food Data, retailers can monitor SKU availability in real time. From 2020–2025, HEMA experienced an 18% increase in high-demand stockouts during peak seasons, while Woolworths reduced stockouts by 12% by leveraging automated monitoring systems.

By integrating Supermarket Data Scraping Services, businesses can track product replenishment, identify low-stock SKUs, and anticipate demand spikes. Real-time insights allow category managers to adjust inventory proactively and prevent revenue loss.

| SKU Category | HEMA Stockout Rate 2020 | HEMA Stockout Rate 2025 | Woolworths Stockout Rate 2020 | Woolworths Stockout Rate 2025 |

|---|---|---|---|---|

| Beverages | 15% | 12% | 18% | 16% |

| Snacks | 20% | 16% | 22% | 18% |

Competitor Benchmarking & Insights

Competitive benchmarking is essential in grocery retail. By using Amazon and Walmart USA Daily Prices as inspiration for dynamic tracking in Europe, retailers implement Scrape HEMA Grocery Listings for Europe and Scrape Woolworths Grocery Listings for Europe to compare pricing strategies.

Analyzing promotions, discounts, and SKU placement enables businesses to benchmark against peers effectively. For example, HEMA’s organic snacks saw a 12% higher discount than Woolworths during Q3 2024, indicating opportunities to improve market share.

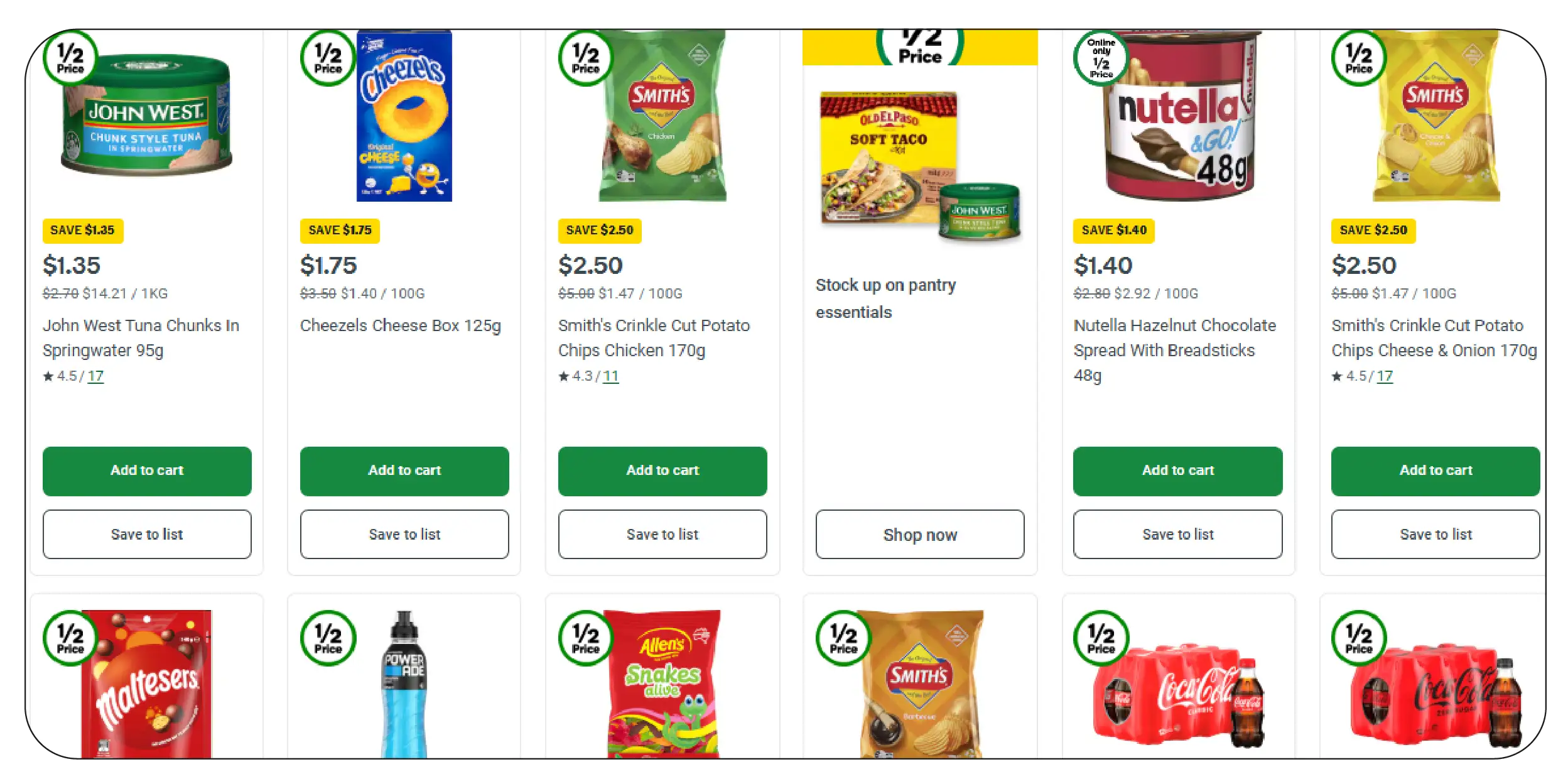

Promotion & Discount Analysis

Promotions and discounts are among the most effective strategies for driving consumer engagement and increasing sales in the European grocery market. To measure promotional effectiveness accurately, businesses increasingly rely on tools like Extract European Grocery Discounts Data, which allows retailers to capture real-time pricing, bundle offers, flash sales, and seasonal promotions from HEMA and Woolworths. Between 2020 and 2025, these strategies have shown a direct correlation with sales volume growth. For example, Woolworths’ bundled beverage promotions in Q4 2023 increased sales of select SKUs by 18% compared to standard pricing periods, while HEMA’s seasonal snack offers boosted repeat purchases by 15% during the same period.

Real-time monitoring of discounts enables retailers to understand which promotions resonate with consumers and how competitors are adjusting their pricing strategies. For instance, by analyzing Scrape HEMA Grocery Listings for Europe, businesses can track the frequency and depth of discounts, identifying patterns in high-demand categories like snacks, beverages, and dairy products. Similarly, Scrape Woolworths Grocery Listings for Europe allows companies to benchmark discount strategies against competitors, ensuring their campaigns remain competitive and effective.

Historical data analysis from 2020–2025 reveals that strategic discounting contributes to a measurable uplift in sales across multiple categories. Grocery staples such as milk, bread, and packaged foods showed an average sales increase of 15–20% during targeted promotional campaigns. Seasonal promotions, particularly during holidays and back-to-school periods, produced even higher lift rates, sometimes exceeding 25% in high-demand SKUs.

Additionally, AI-driven insights allow businesses to predict which products are likely to perform best under promotional conditions. By integrating European Grocery Market Intelligence and SKU-level data with promotional analysis, companies can not only optimize pricing but also allocate inventory efficiently, reducing the risk of stockouts while maximizing ROI from discounts.

In conclusion, robust discount tracking through Extract European Grocery Discounts Data provides retailers with actionable insights that improve campaign planning, competitive benchmarking, and inventory management. This data-driven approach ensures that promotional activities deliver maximum value and measurable revenue growth.

Boost sales with real-time promotion insights—track HEMA & Woolworths discounts, bundles, and seasonal offers using AI-powered scraping!

Data-Driven Consumer Insights

Understanding consumer behavior is critical for success in Europe’s competitive grocery market. With European Grocery Market Intelligence and SKU-level data, retailers can uncover actionable insights into changing preferences, emerging trends, and product performance. Between 2020 and 2025, consumer demand for specialized products, including gluten-free, organic, and plant-based items, has increased significantly. For example, HEMA recorded a 25% rise in gluten-free product purchases, while Woolworths saw a 28% increase in the same category. This shift indicates a growing health-conscious consumer base that actively seeks alternative food options.

AI-powered data extraction allows businesses to monitor these trends in near real-time. By continuously collecting data from HEMA and Woolworths, retailers can identify which SKUs are gaining popularity, which promotions influence purchase behavior, and how regional preferences differ across Europe. The Extract European Grocery Product Data from HEMA And Woolworths tool provides the granular insights necessary for category managers and planners to adjust assortments proactively.

Consumer sentiment analysis, integrated with SKU-level data, also highlights which products are resonating well and which may need repositioning. For instance, tracking Scrape HEMA Grocery Listings for Europe and Scrape Woolworths Grocery Listings for Europe alongside pricing and discount data reveals patterns in consumer preferences. Seasonal fluctuations, such as increased plant-based product demand in Q1 2024 or higher beverage consumption during summer months, can be mapped accurately to drive sales forecasting and inventory planning.

Furthermore, combining European Grocery SKU Tracking via Web Scraping with market intelligence provides retailers the ability to identify emerging trends before they reach peak popularity. This proactive approach allows businesses to align promotions, pricing, and stock with real-time demand signals.

Between 2020 and 2025, data-driven insights have allowed retailers to reduce stockouts by 12%, optimize category-specific marketing strategies, and increase overall sales efficiency. The integration of AI and automated data extraction ensures that insights are timely, accurate, and actionable, giving brands a strategic edge in Europe’s dynamic grocery market.

In conclusion, leveraging European Grocery Market Intelligence and AI-driven SKU data empowers retailers to understand consumer behavior deeply, respond to changing trends rapidly, and make informed, strategic decisions that enhance growth and customer satisfaction.

Why Choose Product Data Scrape?

Product Data Scrape empowers businesses with advanced, automated solutions to Extract European Grocery Product Data from HEMA And Woolworths. Our platform provides accurate, real-time insights into SKU performance, pricing trends, discounts, and consumer behavior. Using Supermarket Data Scraping Services, companies save time, reduce errors, and gain actionable intelligence for strategic decision-making.

Conclusion

In the rapidly evolving European grocery market, staying competitive requires precise, real-time data. By leveraging Extract European Grocery Product Data from HEMA And Woolworths, retailers can track SKU trends, optimize pricing, monitor promotions, and understand consumer preferences.

Unlock actionable grocery insights today with Product Data Scrape and transform your retail strategies for 2025 and beyond!

📩 Email: info@productdatascrape.com

📞 Call or WhatsApp: +1 (424) 377-7584

🔗 Read More: https://www.productdatascrape.com/extract-european-grocery-data-hema-woolworths.php

🌐 Get Expert Support in Web Scraping & Datasets — Fast, Reliable & Scalable! 🚀📊

Comments

Post a Comment