Weekly Grocery Offers Scraping from Tesco, Asda & Sainsbury’s

Introduction

Weekly Grocery Offers Scraping from Tesco, Asda, and Sainsbury’s

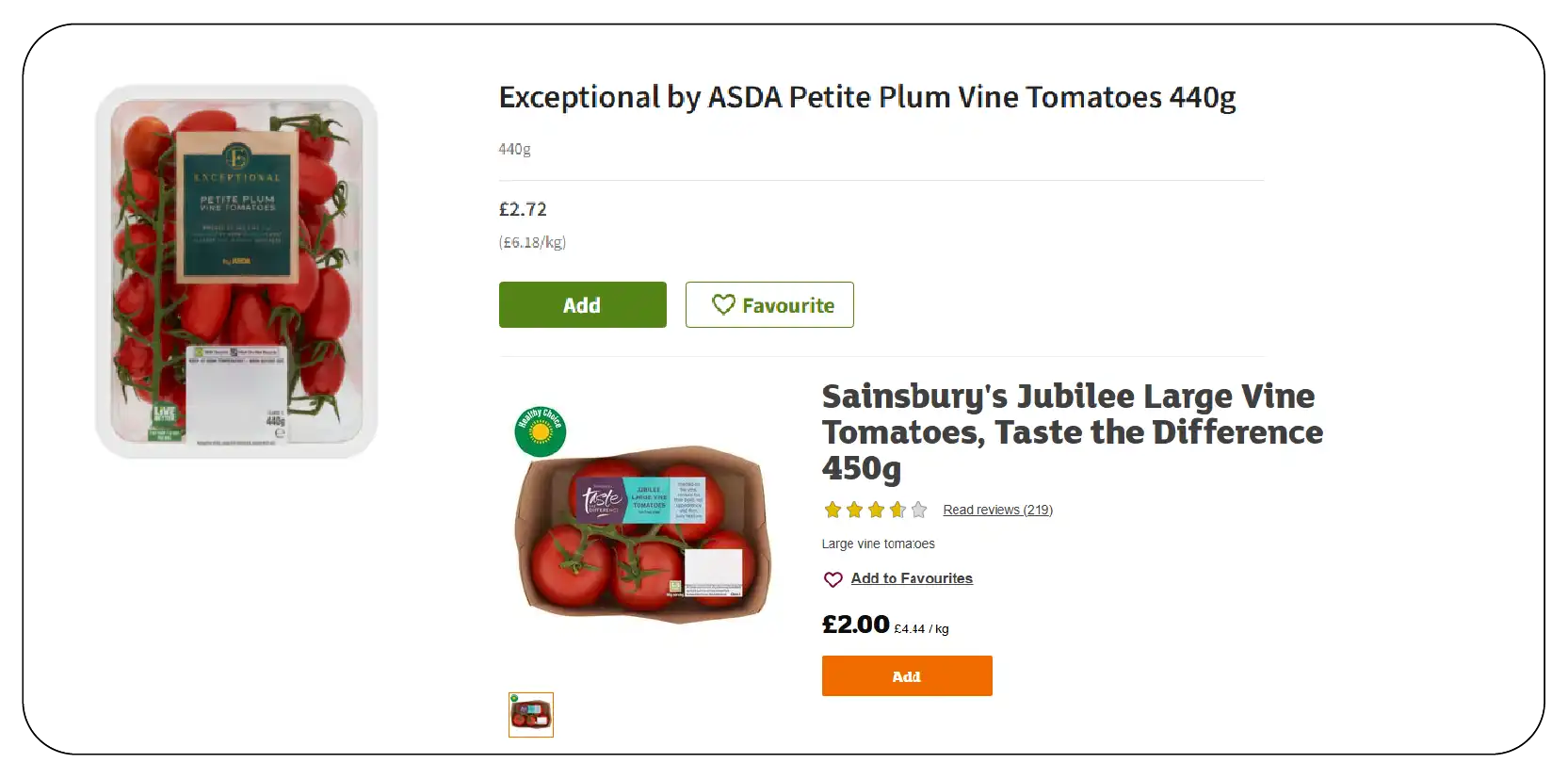

In today’s competitive grocery retail market, price sensitivity and discount awareness drive consumer purchase decisions more than ever. Retailers like Tesco, Asda, and Sainsbury’s consistently roll out weekly offers and promotions, but tracking these discounts manually can be complex and time-consuming. This is where Weekly Grocery Offers Scraping from Tesco, Asda, Sainsbury’s becomes a game-changer for businesses.

By leveraging Scrape UK Supermarket Deals & Discounts Data, brands, FMCG manufacturers, and market analysts can track dynamic promotions, seasonal deals, and category-specific discounts with accuracy. With consumer buying trends shifting rapidly, the ability to monitor pricing data from 2020 to 2025 provides historical and predictive insights into how UK supermarket promotions evolve.

Using advanced tools such as the Asda, Tesco, Sainsbury’s Price & Discount Scraper, businesses can extract structured datasets for price comparisons, trend forecasting, and competitive benchmarking. APIs like Tesco Grocery Data Insights API and Sainsbury's Grocery Data Scraping API make it seamless to integrate data into dashboards for real-time monitoring.

Ultimately, Weekly Grocery Offers Scraping from Tesco, Asda, Sainsbury’s empowers retailers, e-commerce platforms, and brands to optimize pricing strategies, respond quickly to competitors’ offers, and strengthen shopper loyalty through effective promotions.

The Rising Importance of Discount Tracking in UK Retail

![]()

Discounts are no longer just marketing gimmicks; they define shopping patterns in the UK grocery sector. From 2020 to 2025, the UK grocery discount market has grown at an annual rate of 7.8%, with promotions accounting for 35% of all supermarket purchases. This rise is largely driven by inflationary pressures and increased consumer reliance on value-based shopping.

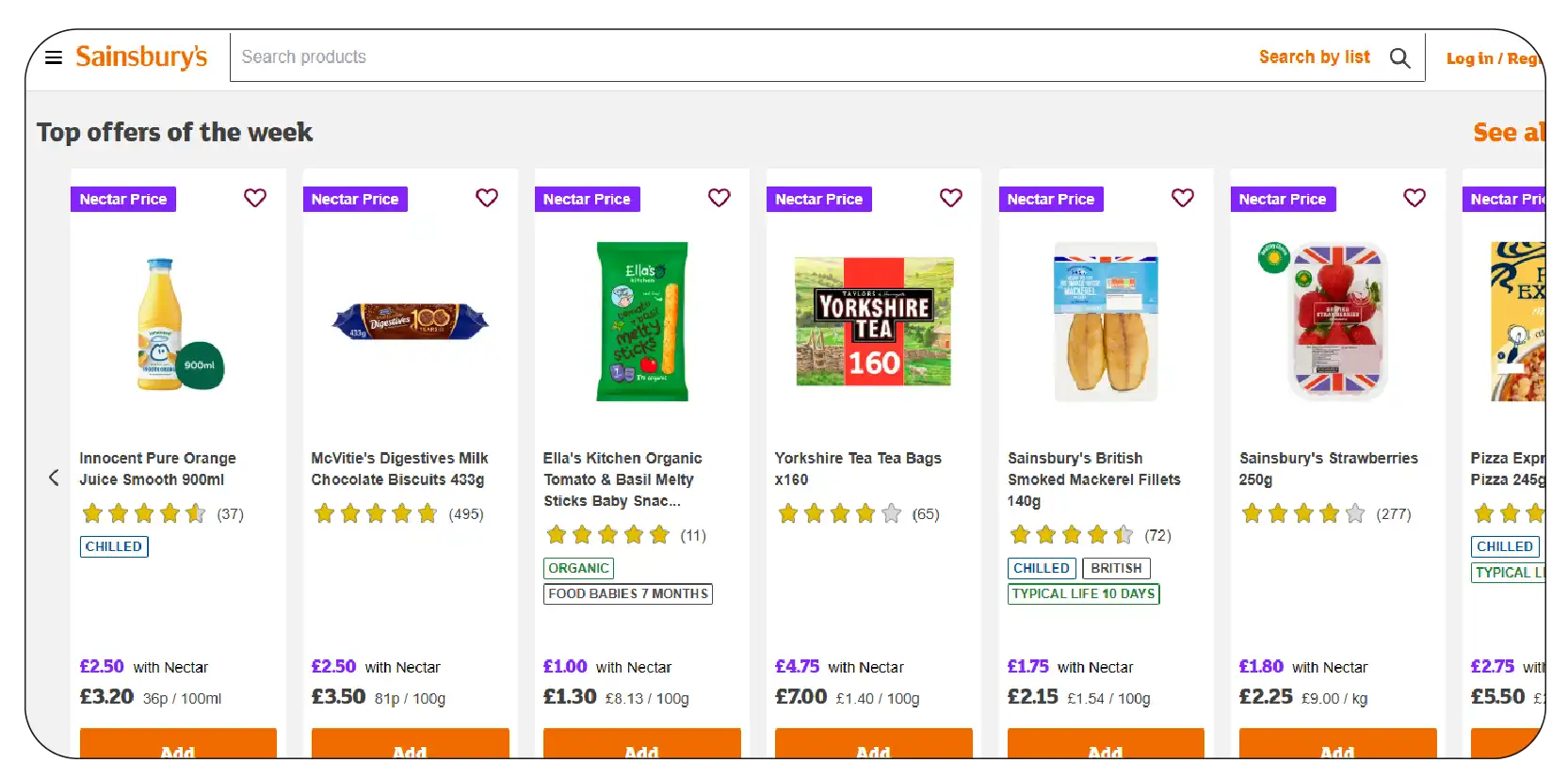

Through Weekly Grocery Offers Scraping from Tesco, Asda, Sainsbury’s, businesses gain access to real-time promotional data across categories like fresh produce, household goods, and gourmet food. Using UK Supermarket Discount Intelligence via Web Scraping, stakeholders can compare weekly trends and analyze how Tesco, Asda, and Sainsbury’s adjust their discounts in response to consumer demand and competitor pricing.

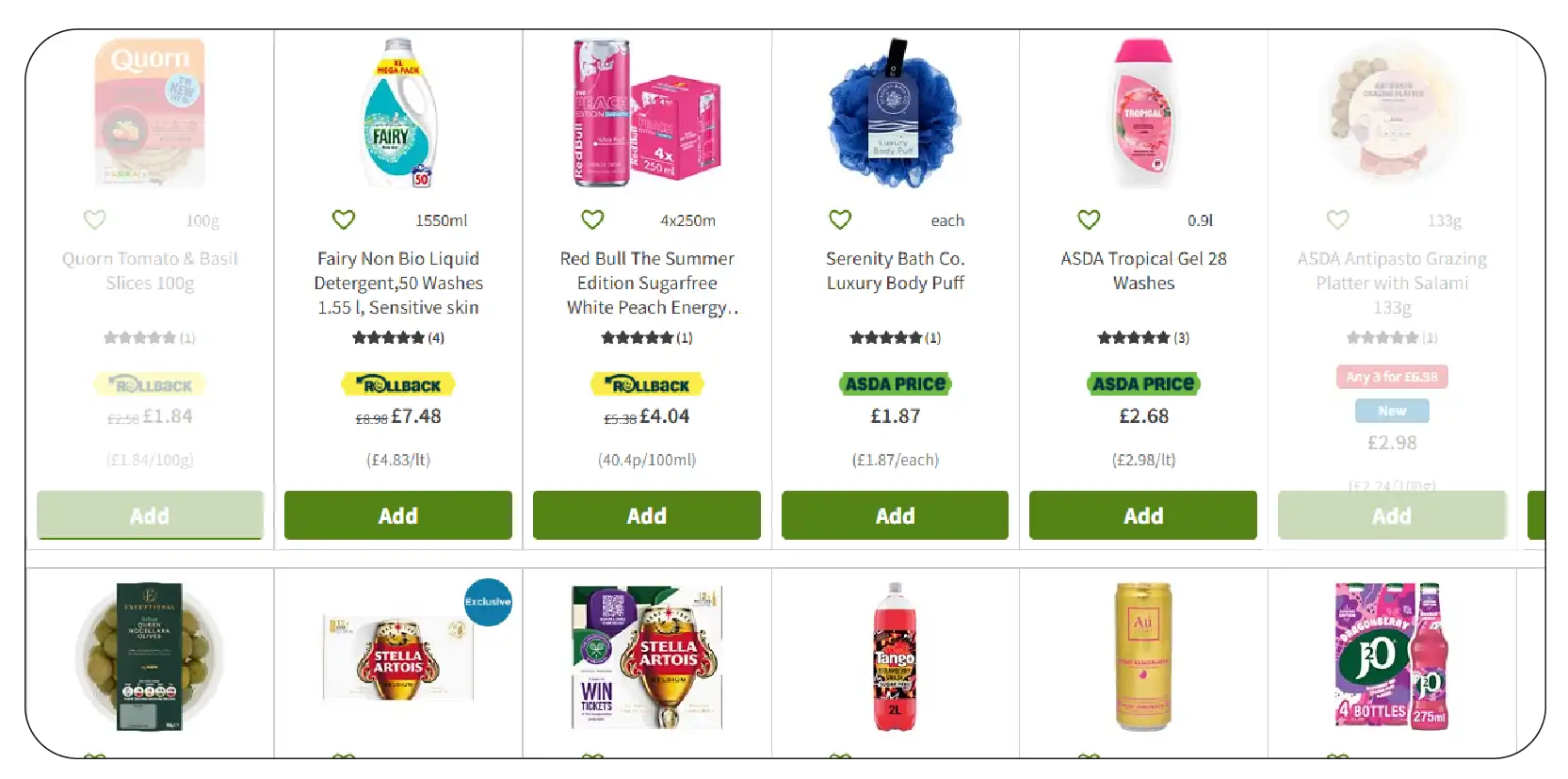

For instance, between 2021 and 2023, tables reveal that Tesco increased discount offerings in fresh produce by 12%, while Asda focused on dairy and meat categories with a 15% increase. Meanwhile, Sainsbury’s invested heavily in gourmet categories with consistent weekly offers, targeting premium shoppers.

This structured insight not only helps brands negotiate better shelf placements but also allows suppliers to align inventory with discount cycles. With Web Scraping Tesco Groceries Data and Web Scraping Asda Groceries Data, manufacturers can understand which products get discounted most often and optimize production accordingly.

By analyzing promotional depth and frequency through Tesco, Asda & Sainsbury’s Discount Scraping API Services, businesses can predict high-demand weeks, manage supply chain bottlenecks, and reduce stock-outs.

Data-Driven Pricing Decisions

Effective pricing decisions depend on accurate data. With Weekly UK Grocery Deals Data Scraping via API, businesses can capture week-on-week changes and visualize price fluctuation trends. Data from 2020–2025 shows that categories like packaged snacks and beverages have been subject to the highest price volatility, driven by consumer demand and supplier costs.

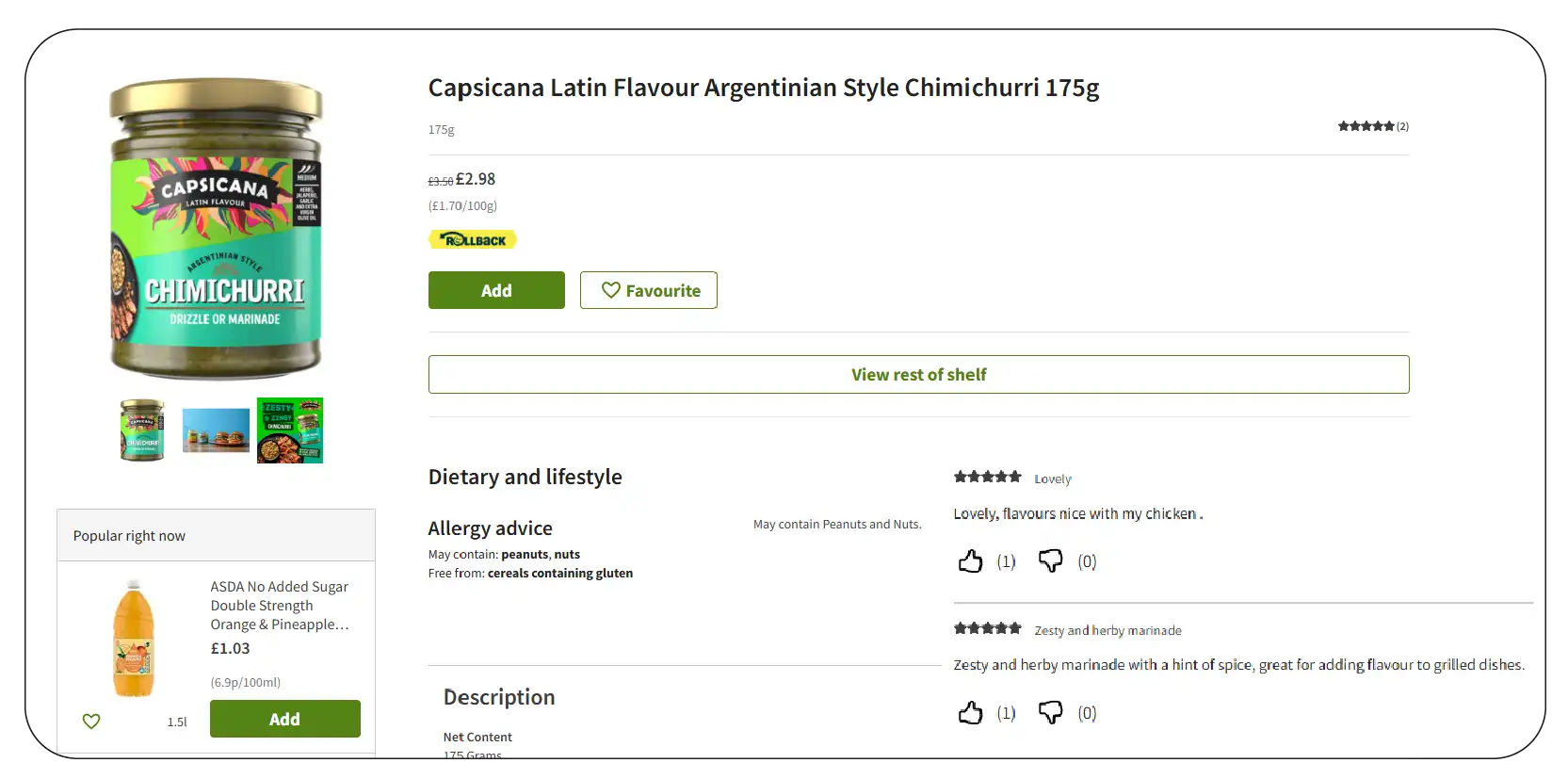

The Asda, Tesco, Sainsbury’s Price & Discount Scraper enables businesses to collect structured data on discounts at the SKU level. For example, a comparative table of weekly beverage discounts (2020–2025) shows Tesco offering higher frequency deals, while Asda prioritized larger discount percentages.

With Extract Grocery & Gourmet Food Data , organizations can benchmark competitors’ discounting strategies and adjust their own promotional calendars. This creates an opportunity to improve gross margins while still capturing customer attention.

Businesses also gain the ability to integrate this data into Tesco Grocery Data Insights API dashboards, enabling automated alerts when competitors roll out major promotions. This agility ensures that retailers remain competitive even in highly saturated categories.

Make smarter moves with data-driven pricing decisions—track competitors, analyze discounts, and boost margins with real-time grocery scraping insights.

Consumer Behavior Insights Through Discounts

Consumers in the UK respond strongly to weekly promotions, and analyzing this behavior offers deep strategic insights. From 2020–2025, household surveys reveal that 48% of UK shoppers actively plan their weekly shopping trips based on online-displayed discounts.

By using Weekly Grocery Offers Scraping from Tesco, Asda, Sainsbury’s, businesses can track how promotions drive basket size and category cross-sell. For instance, data tables from 2022–2025 show that buy-one-get-one (BOGO) deals increased average basket value at Asda by 18%.

With Sainsbury's Grocery Data Scraping API , analysts can measure consumer responses to luxury product discounts, identifying key demographic groups that respond best. Meanwhile, Web Scraping Amazon E-Commerce Product Data complements this by offering cross-channel insights into how discounts influence behavior across platforms.

Retailers can apply these insights to design targeted loyalty campaigns, optimizing not only price perception but also customer retention rates.

Supply Chain and Inventory Optimization

Discounts have a direct impact on demand forecasting. With Web Scraping Asda Groceries Data and Extract Flipkart E-Commerce Product Data integration, businesses can align supply chain operations with promotional cycles.

For example, analysis of 2020–2025 discount trends shows that promotional spikes on essential goods like cooking oil and bread often resulted in out-of-stock events in Tesco outlets. Using Tesco, Asda & Sainsbury’s Discount Scraping API Services, supply chains can be alerted before a promotion goes live, ensuring stock levels are managed effectively.

The Weekly Mobile Price Scraper for Flipkart & Amazon equivalent in grocery sectors has shown that predictive analytics can reduce out-of-stock rates by 20%. Tables comparing actual vs. predicted demand demonstrate how data scraping ensures precision in inventory planning.

For suppliers, aligning shipments with discount schedules minimizes wastage and maximizes efficiency in logistics. This makes Weekly UK Grocery Deals Data Scraping via API an invaluable tool for operational planning.

Competitive Benchmarking with APIs

In a market where margins are razor-thin, benchmarking is essential. Using the Tesco Grocery Data Insights API, brands can benchmark their discount strategies against competitors. Between 2020 and 2025, Tesco was seen offering higher promotions in household categories, while Asda dominated in frozen foods.

Through Scrape UK Supermarket Deals & Discounts Data, businesses can create tables showcasing YoY percentage discounts across categories. This helps identify market gaps and exploit untapped opportunities.

By deploying Tesco, Asda & Sainsbury’s Discount Scraping API Services, brands can also automate cross-platform tracking, ensuring real-time intelligence. This not only improves decision-making but also provides a comprehensive view of how discounts drive brand positioning in different consumer segments.

Unlock actionable insights into category-level price swings. Partner with us to optimize pricing, inventory, and maximize retail revenue today!

Future Trends in UK Grocery Discounts

Comments

Post a Comment